The DDB method contrasts sharply with the straight-line method, where the depreciation expense is evenly spread over the asset’s useful life. The choice between these methods depends on the nature of the the elderly or disabled irs tax credit for 2020 details asset and the company’s financial strategies. DDB is preferable for assets that lose their value quickly, while the straight-line method is more suited for assets with a steady rate of depreciation.

Outsourced Bookkeeping for Ecommerce: Benefits and Cost Savings Explained

The double declining balance method of depreciation is just one way of doing that. Double declining balance is sometimes also called the accelerated depreciation method. Businesses use accelerated methods when having assets that are more productive in their early years such as vehicles or other assets that lose their value quickly. The double declining balance method is considered accelerated because it recognizes higher depreciation expense in the early years of an asset’s life. By applying double the straight-line depreciation rate to the asset’s book value each year, DDB reduces taxable income initially. By following these steps, you can accurately calculate the depreciation expense for each year of the asset’s useful life under the double declining balance method.

What Is the Double-Declining Balance (DDB) Depreciation Method?

- Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

- Our Financial Close Software is designed to create detailed month-end close plans with specific close tasks that can be assigned to various accounting professionals, reducing the month-end close time by 30%.

- We have helped accounting teams from around the globe with month-end closing, reconciliations, journal entry management, intercompany accounting, and financial reporting.

- In year one, the depreciation expense is twice that of the straight-line method, or 2/5 (40%) of $10,000, which equals $4,000.

This will help demonstrate how this method works with a tangible asset that rapidly depreciates. For instance, if a car costs $30,000 and is expected to last for five years, the DDB method would allow the company to claim a larger depreciation expense in the first couple of years. This not only provides a better match of expense to the car’s usage but also offers potential tax benefits by reducing taxable income more significantly in those initial years.

Step 3 of 3

This method helps businesses recognize higher expenses in the early years, which can be particularly useful for assets that rapidly lose value. The double declining balance method of depreciation reports higher depreciation charges in earlier years than in later years. The higher depreciation in earlier years matches the fixed asset’s ability to perform at optimum efficiency, while lower depreciation in later years matches higher maintenance costs. However, computing the double declining depreciation is very systematic. It’s ideal to have accounting software that can calculate depreciation automatically. This method falls under the category of accelerated depreciation methods, which means that it front-loads the depreciation expenses, allowing for a larger deduction in the earlier years of an asset’s life.

Learn how to build, read, and use financial statements for your business so you can make more informed decisions. To use the template above, all you need to do is modify the cells in blue, and Excel will automatically generate a depreciation schedule for you. If you need expert bookkeeping assistance, Bench can help you get your books in order while you focus on what’s important for your business. The difference is that DDB will use a depreciation rate that is twice that (double) the rate used in standard declining depreciation. As a hypothetical example, suppose a business purchased a $30,000 delivery truck, which was expected to last for 10 years.

As the asset’s book value decreases, the depreciation expense also decreases. The underlying idea is that assets tend to lose their value more rapidly during their initial years of use, making it necessary to account for this reality in financial statements. An asset for a business cost $1,750,000, will have a life of 10 years and the salvage value at the end of 10 years will be $10,000. You calculate 200% of the straight-line depreciation, or a factor of 2, and multiply that value by the book value at the beginning of the period to find the depreciation expense for that period.

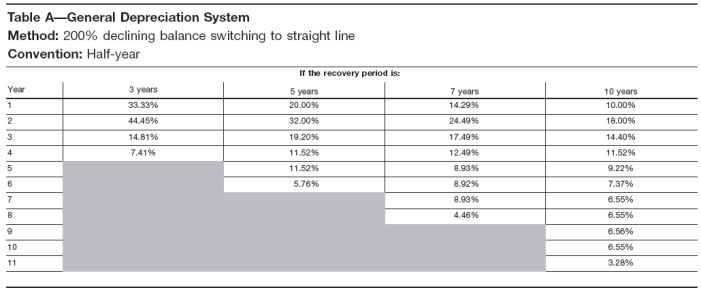

So, if an asset cost $1,000, you might write off $100 every year for 10 years. Aside from DDB, sum-of-the-years digits and MACRS are other examples of accelerated depreciation methods. They also report higher depreciation in earlier years and lower depreciation in later years.

Similarly, compared to the standard declining balance method, the double-declining method depreciates assets twice as quickly. The double declining balance method (DDB) describes an approach to accounting for the depreciation of fixed assets where the depreciation expense is greater in the initial years of the asset’s assumed useful life. Depreciation is a fundamental concept in accounting, representing the allocation of an asset’s cost over its useful life. Various depreciation methods are available to businesses, each with its own advantages and drawbacks. One such method is the Double Declining Balance Method, an accelerated depreciation technique that allows for a more significant portion of an asset’s cost to be expensed in the earlier years of its life. The “double” means 200% of the straight line rate of depreciation, while the “declining balance” refers to the asset’s book value or carrying value at the beginning of the accounting period.

The following examples show the application of the double and 150% declining balance methods to calculate asset depreciation. In the above example, we assumed a depreciation rate equal to twice the straight-line rate. However, many firms use a rate equal to 1.5 times the straight-line rate. As you use the car or truck, it accumulates wear and tear, as well as mileage. The useful life of a car isn’t very long, especially when being used for business purposes.

When you choose to use the double declining method, the rate of depreciation has to be maintained for the asset’s life. The rate is set after the first depreciation period, and is applied to the declining book value each period that follows. When you talk to a financial professional about depreciation, they’re going to recommend one of two methods. The two methods are the double declining method, and the straight line depreciation method.

But as time goes by, the fixed asset may experience problems due to wear and tear, which would result in repairs and maintenance costs. That’s why depreciation expense is lower in the later years because of the fixed asset’s decreased efficiency and high maintenance cost. A big part of being a business owner is understanding the assets and expenses your business has.